Tax-efficient, actively managed investment portfolios for private individuals, business owners, trusts and charities

HOW WE WORK

The investment

process...

STEP 1

Initial conversation

We will answer any questions you might have and provide you with full details of our service, including information on charges.

STEP 2

Review of financial circumstances

We complete a comprehensive review of your overall financial circumstances so that we have an in-depth understanding of your situation.

STEP 3

Assessing and aligning

We assess your attitude to risk and listen carefully to your financial aspirations. We discuss your investment preferences so that your portfolio can be tailored to your values.

STEP 4

Portfolio construction

We construct diversified and well-balanced portfolios specifically designed to meet your investment objectives. You may require income, capital growth or a combination of both. Whatever your requirements, we tailor a solution for you.

STEP 5

Management of portfolio

Portfolios are actively managed using sophisticated investing techniques and tax-efficient strategies. We manage your portfolio’s risk according to your risk profile, mitigating potential losses and targeting stable growth within your comfort zone. We manage portfolios in tax-efficient wrappers including ISAs, Pensions (SIPPs) and Offshore Bonds. Regulatory oversight, the smooth administration of your account and the safeguarding of your assets is provided by Raymond James Investment Services.

STEP 6

Comprehensive reporting

Client-friendly reports are provided on a quarterly basis. Your portfolio is benchmarked against market indices so that you can easily monitor the performance. Access to a user-friendly client portal provides comprehensive information on your portfolio including a current valuation.

Access to the Investment Manager

You have full access to the Investment Manager of your portfolio and we encourage regular face-to-face meetings, either in person or online, so that you remain informed on the performance of your portfolio.

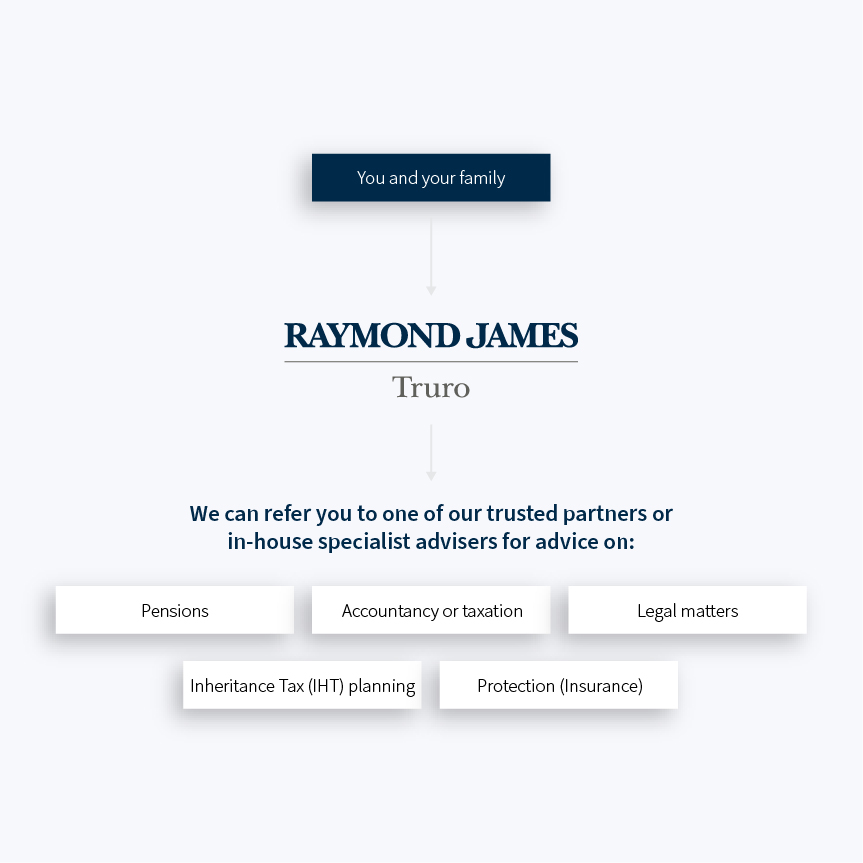

As Chartered Investment Managers, we specialise in managing investment portfolios. If, during our discussion, we identify other areas of advice that you might require, we can refer you to one of our trusted partners or in-house specialist advisers. Your ongoing relationship is with your investment manager, and you only pay for additional areas of advice if you need it.

Alternatively, we can work alongside your existing professional advisers.